do you pay taxes when you sell a car in illinois

In Illinois you have to follow the standard process of transferring and. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference.

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

Do I have to pay any tax.

. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. The trade off to eliminate the tax cap was to slightly increase the tax on private car sales. To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person.

The following applies to sales between private individuals. Unless of course you. You do not need to pay sales tax when you are selling the vehicle.

There are some circumstances where you must pay taxes on a car sale. You do not need to pay sales tax when you are selling the vehicle. What is the sales tax on a car purchased in Illinois.

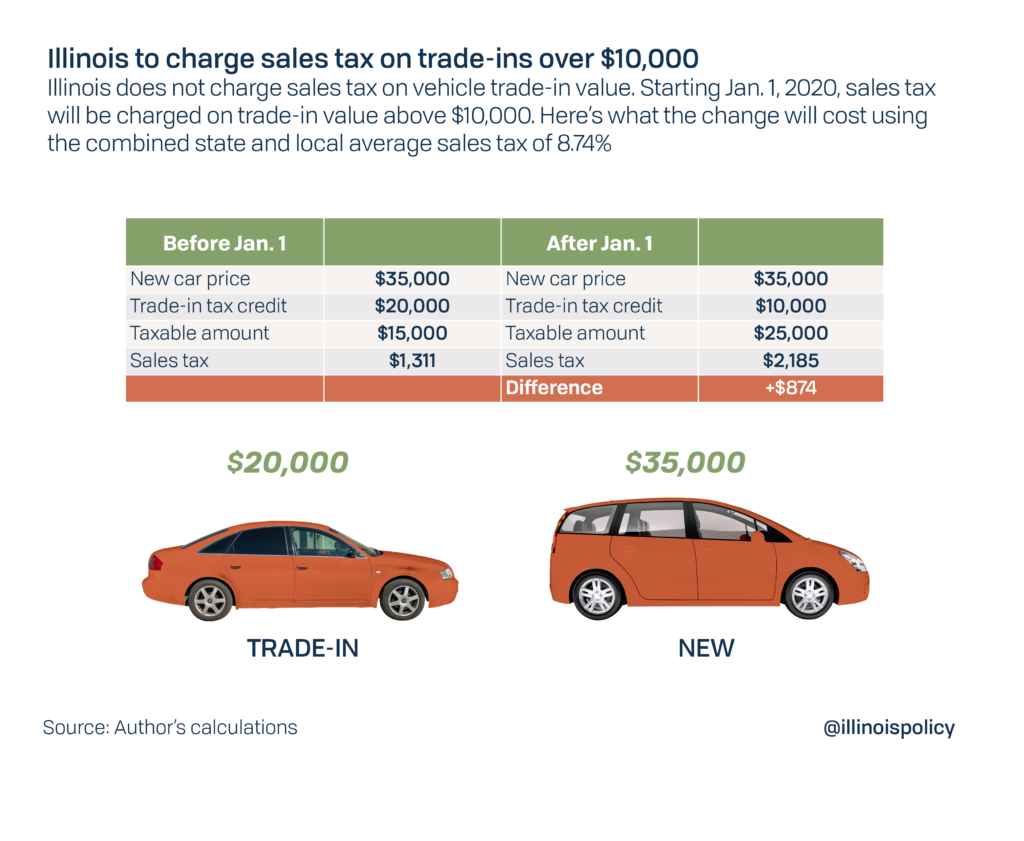

The process is different for sales made by car dealers. If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000. Heres a vehicle use tax chart.

There is also between a 025 and 075 when it comes to county tax. The tax rate is based on the purchase price or fair market value of the car. Thats 2025 per 1000.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Although a car is considered a capital asset when you originally purchase it both state. Heres how the law works.

Gifting a car to someone is a good way to avoid taxes and fees you would have to pay in a private sale. In addition to state and county tax the City of. A list of all.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Thankfully the solution to this dilemma is pretty simple. Who Pays Sales Tax.

The buyer is responsible for paying the sales tax. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. The state sales tax on a car purchase in Illinois is 625.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. To legally transfer the car you must sign the. Instead the buyer is.

If you bought a vehicle from a car dealer or private party out of state and want to register it in Illinois you must pay Illinois car sales tax and submit the original title for transfer. However you do not pay that tax to the car dealer or individual selling the car. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

Do you have to pay taxes on a car thats a gift in Illinois. The short answer is maybe. As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois.

The average local tax rate in Illinois is 1903 which brings the.

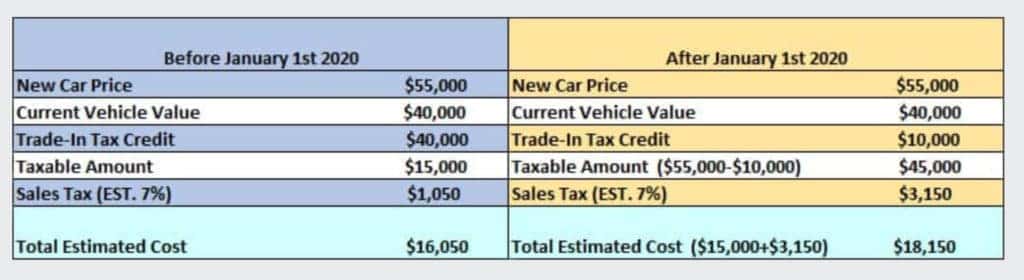

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Important Tax Changes For Illinois Car Buyers The Driven Fiduciary

What Is The Safest Form Of Payment When Selling A Car Sell My Car In Chicago

Used Cars In Illinois For Sale Enterprise Car Sales

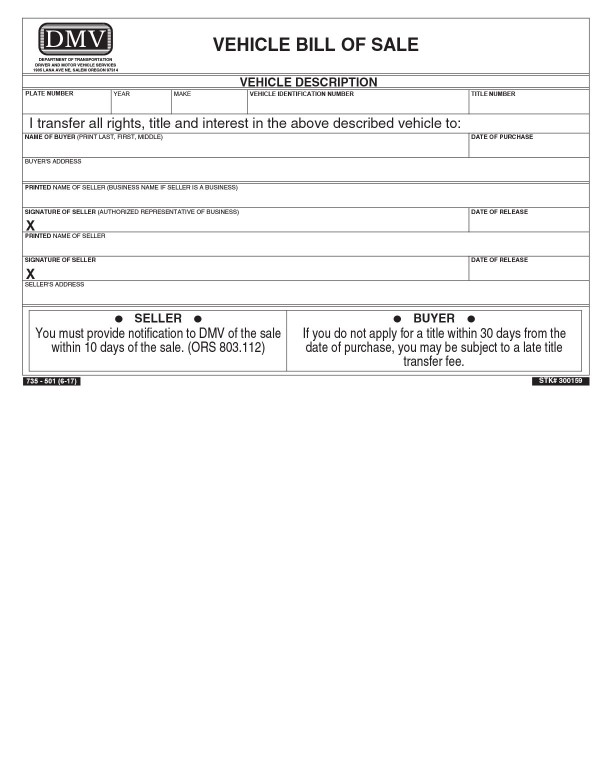

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Used Cars In Illinois For Sale Enterprise Car Sales

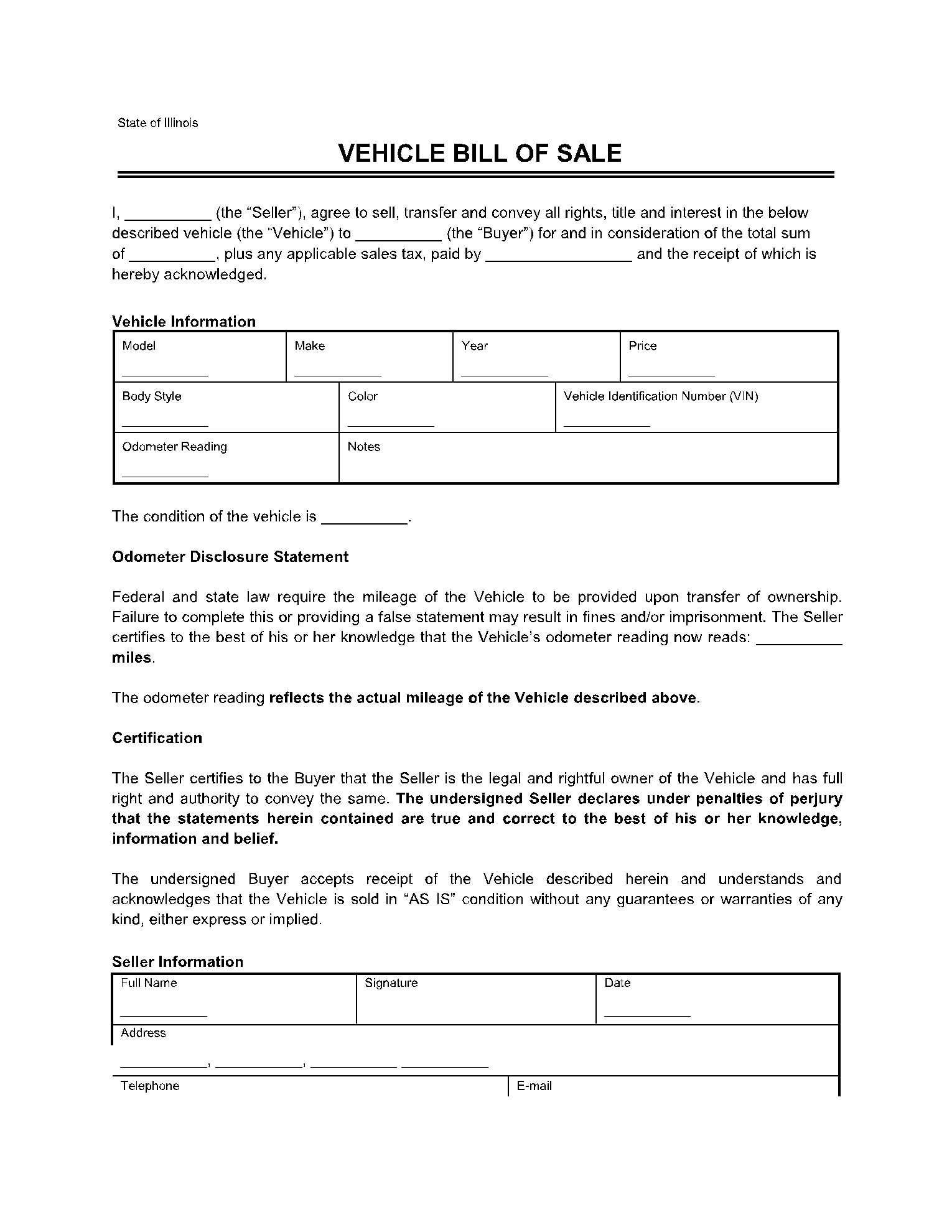

Illinois Vehicle Bill Of Sale Template Free Download Cocosign

2020 Illinois Trade In Sales Tax Law Change Land Rover Hinsdale

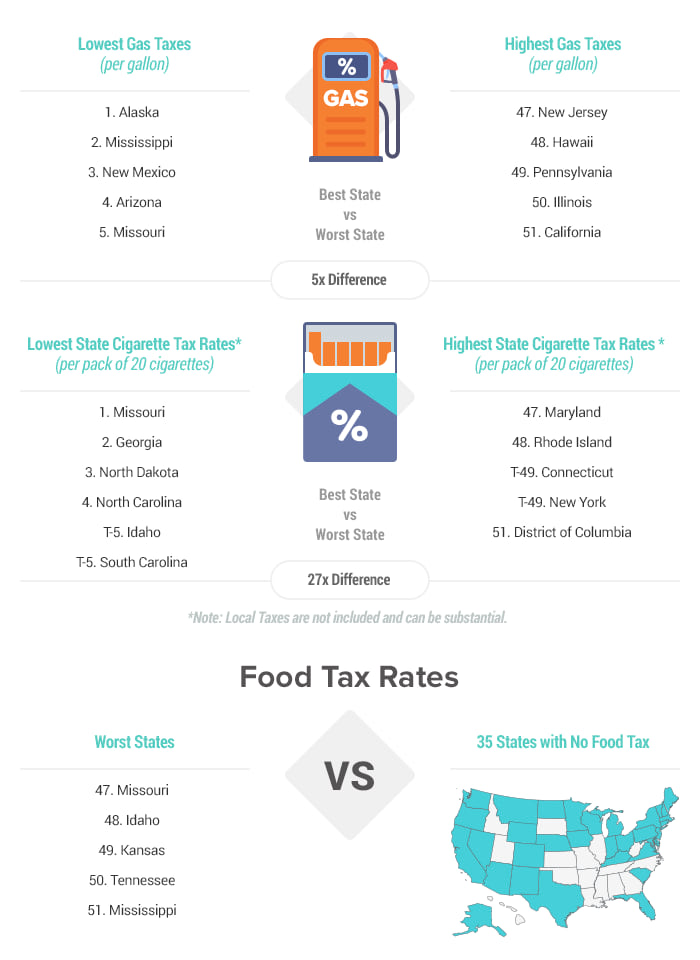

States With The Highest Lowest Tax Rates

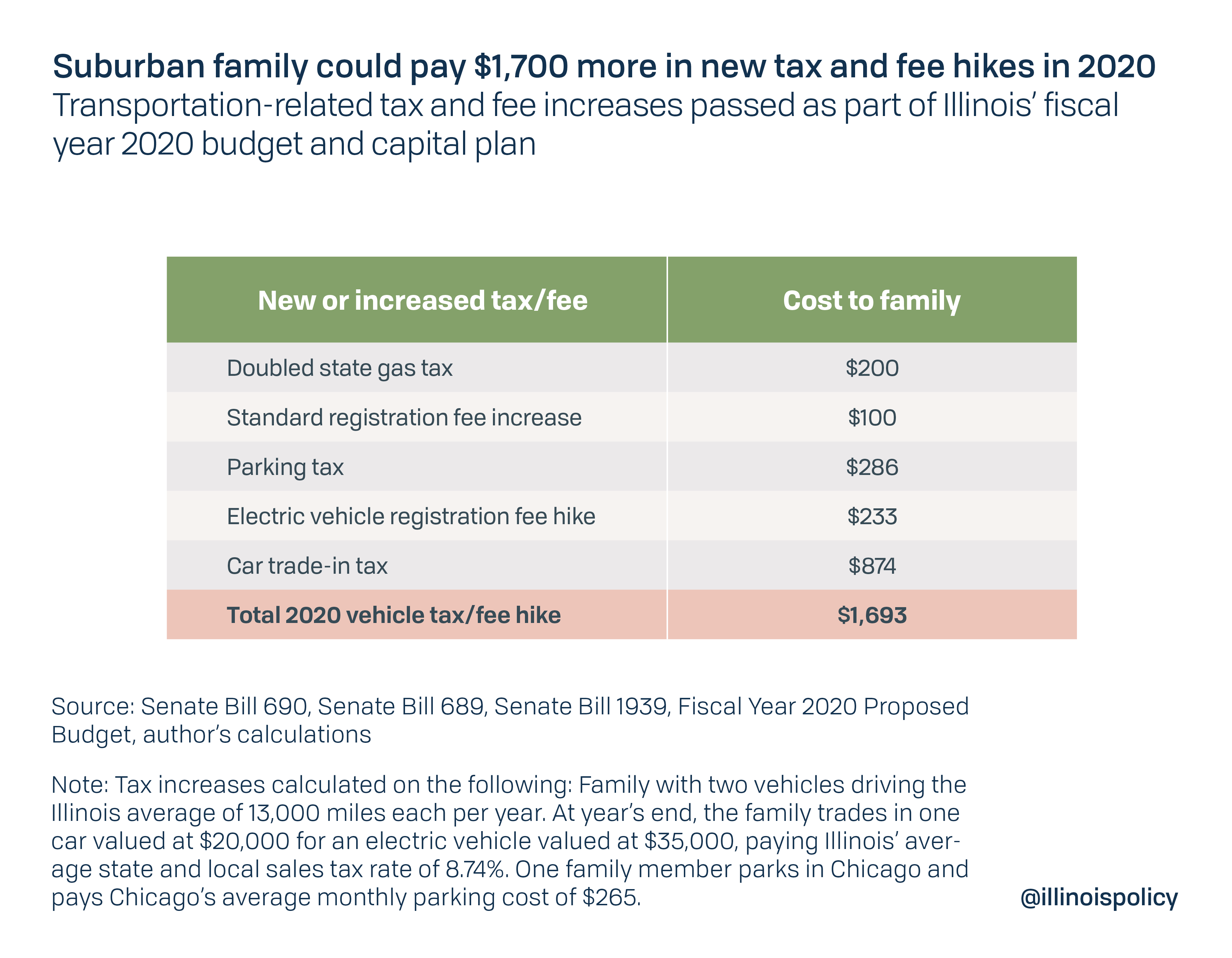

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

What Is Illinois Car Sales Tax

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Sell A Car In Illinois Metromile

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

What To Know About Taxes When You Sell A Vehicle Carvana Blog