what to do if tax return is rejected

If you filed your return by the due date and it gets rejected the IRS. Enter the wrong date of birth.

How To Handle A Tax Return Rejected By The Irs

Use the E-file Rejection Report to correct any errors on your rejected HR Block return.

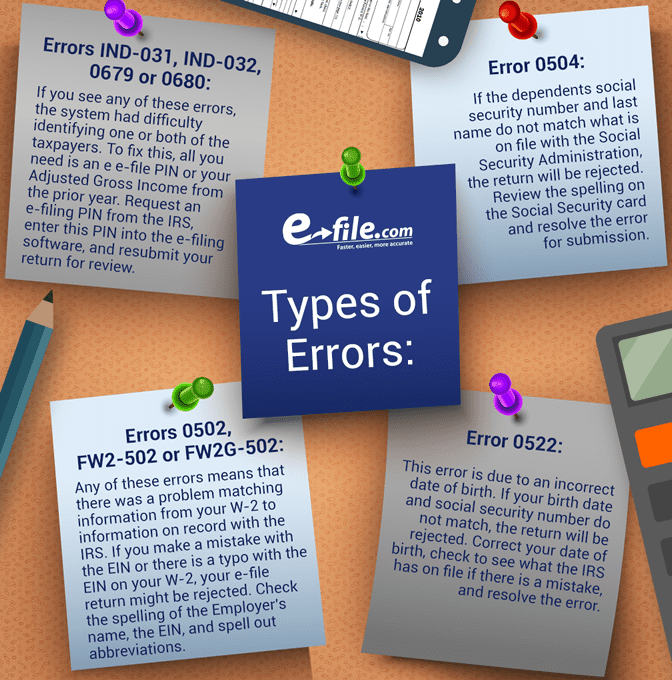

. Tax return rejections happen more often than youd think so dont worry if yours is sent back. It also sends a rejection code and explanation of why the e-filed return was rejected. To fix this all you need is an e e-file PIN or your Adjusted Gross Income from the prior year.

Ad Apply For Tax Forgiveness and get help through the process. Starting with tax year 2021 electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit APTC on Form 8962 Premium Tax Credit PTC but does not attach the form to the tax returnWhen we reject the return through the software you are using you will see a paragraph that explains what you. Ad Stand Up To The IRS.

A tax return rejected code R0000-902-01 means your Social Security Number has been used in that current year to e-file a tax return. You may end up having your tax return rejected if you. Click View Rejection Report.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Misspell your name hey it can happen to the best of us The IRS will. If you had a company e-file your return it must either correct the mistake on your behalf or inform you that your return was rejected within 24 hours.

Select Fix my return to see your rejection code and explanation. You havent filed if the IRS rejects your return. Just make the corrections and youll be able to make a second attempt at e-filing.

Name your spouses name if youre jointly filing or names of employers business partners or spouses. Enter the wrong Social Security number. The IRS generally corrects mathematical errors without denying a return.

Prepare e-File and print your tax return right away. This could mean two things. The IRS will then contact you by mail if it needs additional supporting documents.

Select Fix it now and follow the instructions to update the info causing the reject. Click the Check Status link next to the return file in the Continue with a Saved 2021 Return list box. When an e-filed return gets rejected the IRS will often let you know within a few hours.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Your tax return might get rejected if you incorrectly entered your. Sign in to TurboTax.

Dependents claimed on multiple returns. You may end up having your tax return rejected if you. A spouse has already e-filed a return for the said year or someone has stolen the.

If your return is rejected at the end of the filing season you have 5 days to correct any errors and resubmit your return. Tax returns are rejected because a name or number in the tax return does not match the information contained in the IRS databases or the Social Security Administration. In the event that a rejection comes back after the April 15th tax deadline you will be provided an additional five days to fix the errors and retransmit the return.

Heres a list of steps you can take if the IRS initially rejects your return to ensure that it will be accepted when you resubmit it. Enter the wrong date of birth. For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return and mail it.

When youre unsuccessful at e-filing a return the system is set up to generate a reject code so that you know exactly what information is missing or needs to be corrected. Request an e-filing PIN from the IRS enter this PIN into the e-filing software and resubmit your return for review. The IRS will then contact you by mail if it needs additional supporting documents.

For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return and mail it. For example if your return is rejected because of reject code 0500 all this means is. That said you can avoid having your return rejected by double checking the information you enter on.

In most cases if your electronic tax return gets rejected initially by the IRS you will have an opportunity to correct the return and retransmit it. Rather when you first submit your return a computer will verify if all of your basic identifying information such as your Social Security number is correct. Spelling and typo errors can be quick and easy to correct.

Enter the wrong Social Security number. You can even solve the problem online and. The rejection code IND-510 means your Tax Identification Number has been used by someone else to e-file a tax return.

If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you. Misspell your name hey it. Once youve fixed the error select File in the left menu and.

How do I fix my rejected tax return. If your return is rejected you must correct any errors and resubmit your return as soon as possible. If you filed your return by the due date and it gets rejected the IRS.

One number out of place can make your Social Security number the same as another filers and get your tax return rejected. Using all 3 will keep your identity and data safer. You and your ex-spouse both claimed the same dependent child on your.

Your name date of birth andor social security number SSN dont match what the IRS has on file. Open your original e-filed return in the HR Block Tax Software you cant check the status from a duplicate file. Often tax returns are rejected because the taxpayer submitted incorrect information.

What To Do When Your Tax Return Is Rejected Credit Karma

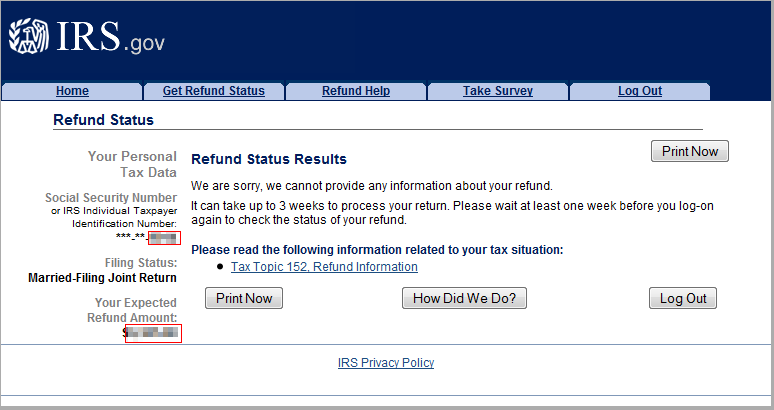

We Cannot Provide Any Information About Your Refund Where S My Refund Tax News Information

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

![]()

Tax Checklist Icon Tax Checklist Tax Preparation Tax Services

Know What Is Online Income Tax Return File Income Tax File Income Tax Income Tax Return

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Feeling Dejected That Your Home Loan Application Got Rejected Not Sure What To Do Next Well Don T Let Disappointment Prevent Y Home Loans Loan The Borrowers

Form Sample Of Business Tax Return Fresh Accident Report Regarding Ar Report Template Professional Template

How Do I Fix A Rejected Return Turbotax Support Video Youtube

How Do I Find Out If My Tax Return Is Accepted E File Com

Audited Books Cannot Be Rejected In Such A Casual Manner Ad Hoc Disallowances Are Arbitrary And Cannot Be Upheld Tax Refund Rejection Audit

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Directive Youtube

Eidl Rejected Unable To Verify Information Cost Of Goods Sold Tax Return Business Owner

What Happens If I Have My Tax Return Rejected The Motley Fool

Do You Know The Reason Behind Rejection Of Gst Registration Follow Gstinsights For Gst Rel Goods And Service Tax Goods And Services Government Organisation

Irs E File Rejection Grace Period H R Block

How To Correct An E File Rejection E File Com

You Could Be Filing A Faulty Tax Return Here S How To Avoid Getting It Rejected Credit Card App Tax Return Rejection

If Irs Rejects Your Form 2290 Here Is How You Correct Them Rejection Irs Forms Correction